5 Shocking St. Paul Housing Facts

At this community event I learned about housing disparities in St. Paul. Margaret Kaplan of the Housing Justice Center shared five frightening facts.

- It will take 240 years to close the wealth gap between black and white households.

- There is a $28,763 gap between white households and households of color.

- The Median credit score in white areas is 720 compared to 570 in non-white areas.

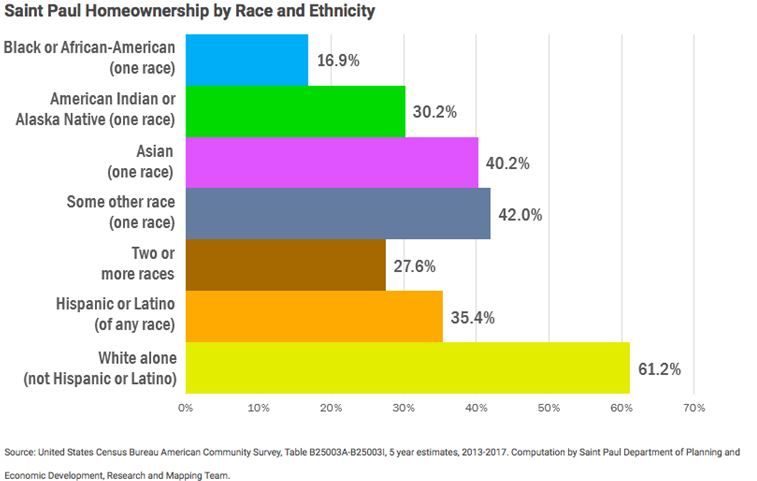

- St. Paul has one of the lowest homeownership rates in the nation among black households.

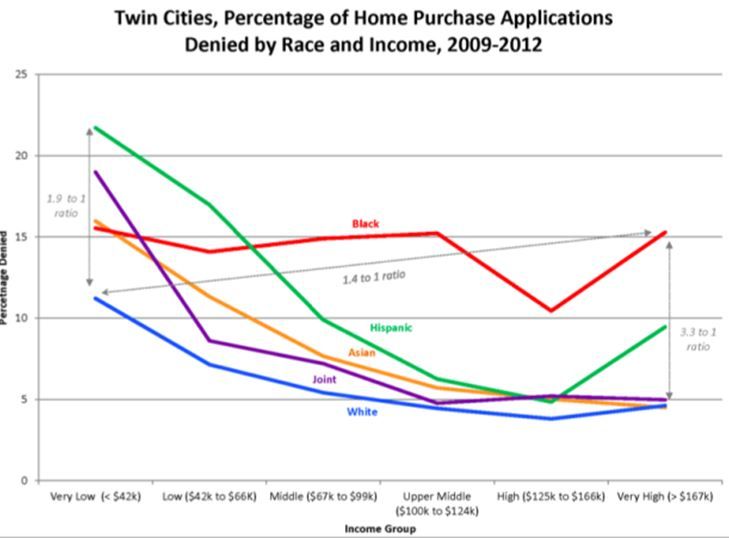

- Black mortgages are denied at a higher rate even with a high income.

At Daily Work, I see many housing challenges faced by job seekers. Job seekers I work with are often experiencing homelessness, staying at shelters, or are couch hopping. Often, it’s hard to know what to prioritize…housing or a job? The answer may seem obvious…you need money to have a home…but holding a job is almost impossible when someone is homeless or dealing with housing insecurity. Once a job seeker has a job, affordable housing is scarce and housing near mass transit is even harder to find. On top of that, legal issues, poor credit, and lack of rental history, among others make housing one of the most common barriers and challenges faced by Daily Work job seekers.

- Mapping Inequality: Redlining in New Deal America

- Jim Crow of the North

- Mapping Prejudice Project

- The Color of Law: A Forgotten History of How the Government Segregated America

- Racial Disparities, Home ownership, and Mortgage Lending

By Laurel McKeag, Case Management Intern